TransEnterix, Inc. (NYSE American:TRXC), a surgical robot manufacturer that is digitizing the interface between the surgeon and the patient to improve minimally invasive surgery, today announced the sale of certain AutoLap ® image-based laparoscope positioning system (AutoLap) assets to Great Belief International Limited (GBIL), for total proceeds of $47.0 million.

The total proceeds to be paid to the Company for the AutoLap product and intellectual property assets is $17 million, payable in the amount of $5 million by July 31, 2019, and $12 million by November 30, 2019. In addition, GBIL is making an equity investment of $30.0 million in TransEnterix common stock at $2.00 per share, payable on or before September 30, 2019. As a part of the sale agreement, the Company retains ownership of the broader intellectual property portfolio it acquired from M.S.T. - Medical Surgery Technologies in October 2018, and will enter into a cross-license agreement with GBIL under which it gains a license to use the AutoLap-related IP sold, and grants GBIL a non-exclusive license to use additional IP in connection with the AutoLap. The Company has entered into an Amendment to its Loan Agreement as part of the process to obtain the consent of its Lender prior to transferring the AutoLap assets to GBIL.

“AutoLap has a track record of success with laparoscopic surgeons across a wide variety of procedures around the globe. GBIL has been a great partner for us in the past, and we believe they will be successful in bringing the benefits of the AutoLap product to the greatest number of laparoscopic surgeons worldwide," said Todd M. Pope, TransEnterix President, and CEO. “This divestiture aligns with our continued focus on commercializing the Senhance Surgical System platform and progressing digital laparoscopy, while securing additional funds for our operations.”

Surgical robotics has become increasingly popular in recent years, providing surgeons with enhanced precision and control during minimally invasive procedures. One of the major players in the surgical robotics industry is TransEnterix, Inc., which has developed several innovative surgical robotics technologies, including the AutoLap system. However, TransEnterix recently announced that it will be selling its AutoLap assets to Great Belief International Limited, a Chinese medical device company. In this essay, we will explore the significance of this announcement, as well as some of the potential implications for the surgical robotics industry.

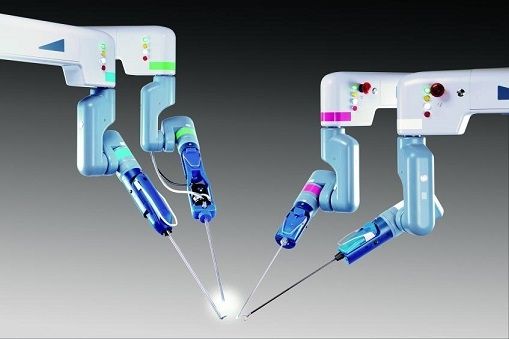

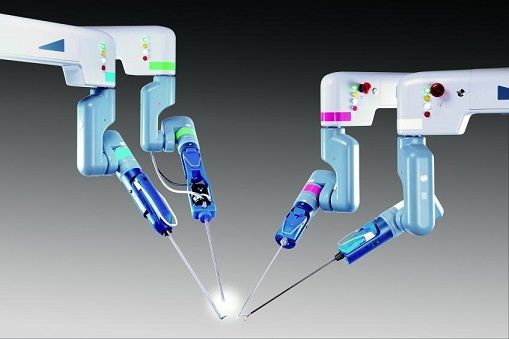

The AutoLap system developed by TransEnterix is a laparoscopic surgical platform that provides surgeons with enhanced control and precision during minimally invasive procedures. The system uses advanced imaging technologies and robotic instruments to help guide the surgeon's movements and provide real-time feedback on the position and orientation of the surgical instruments.

However, despite the potential advantages of the AutoLap system, TransEnterix has struggled to gain market traction for the technology. In a recent announcement, the company stated that it would be selling its AutoLap assets to Great Belief International Limited for an undisclosed sum.

The sale of the AutoLap assets is significant for several reasons. First, it suggests that TransEnterix is focusing its resources on other areas of its business, such as its flagship Senhance surgical robotics platform. This platform, which was approved by the FDA in 2017, provides surgeons with enhanced dexterity and control during minimally invasive procedures, and has been well-received by the surgical community.

Second, the sale of the AutoLap assets to Great Belief International Limited suggests that there may be growing interest in surgical robotics technology in China and other emerging markets. As healthcare systems in these regions continue to develop, there is likely to be increasing demand for innovative medical technologies, including surgical robotics.

However, there are also some potential concerns associated with the sale of the AutoLap assets. For example, some experts have expressed concern about the potential transfer of sensitive intellectual property and technology to foreign companies, particularly those in countries with less robust intellectual property laws.

Additionally, there is a growing concern about the consolidation of the surgical robotics industry, as a few large companies such as Intuitive Surgical, Medtronic, and Johnson & Johnson dominate the market. This consolidation may limit competition and innovation in the industry, potentially driving up the cost of surgical robotics technologies and limiting access to these technologies for smaller medical centers and hospitals.

Despite these concerns, the sale of the AutoLap assets to Great Belief International Limited may ultimately have some positive implications for the surgical robotics industry. For example, the acquisition may help to drive innovation and competition in the industry, as smaller companies and startups seek to develop new technologies and compete with larger players.

Additionally, the acquisition may help to expand access to surgical robotics technology in emerging markets, where healthcare systems are often underdeveloped and patients may have limited access to advanced medical technologies.

Another potential implication of the sale of the AutoLap assets to Great Belief International Limited is the potential for increased collaboration and partnerships between Chinese and American medical device companies. As healthcare systems in China and other emerging markets continue to develop, there may be growing demand for innovative medical technologies, including surgical robotics. This could create opportunities for companies in the United States and other developed countries to partner with Chinese companies to develop and commercialize new surgical robotics technologies for these markets.

However, there are also some potential challenges associated with partnerships between Chinese and American medical device companies. For example, there may be cultural and language barriers that can make it difficult for companies to effectively communicate and collaborate. Additionally, there may be regulatory and legal challenges associated with the transfer of intellectual property and technology between countries, particularly those with different intellectual property laws and regulations.

Another potential implication of the sale of the AutoLap assets to Great Belief International Limited is the potential for increased competition and innovation in the surgical robotics industry. As smaller companies and startups seek to develop new technologies and compete with larger players, there may be opportunities for new breakthroughs in the field of surgical robotics.

However, there are also some potential challenges associated with increased competition and innovation in the industry. For example, there may be a risk of oversaturation in the market, with too many companies competing for a limited number of customers. This could drive down prices and limit profitability for companies in the industry, potentially reducing the amount of investment and innovation in the field.

Additionally, increased competition may also increase the risk of safety concerns and adverse outcomes associated with surgical robotics technologies. As more companies enter the market and compete for market share, there may be a greater focus on speed and efficiency at the expense of safety and quality.

Overall, the sale of TransEnterix's AutoLap assets to Great Belief International Limited is a significant development in the surgical robotics industry. While there are potential risks and challenges associated with the acquisition, such as the potential transfer of sensitive intellectual property and the consolidation of the industry, there are also potential benefits, such as increased collaboration and partnerships between Chinese and American medical device companies and increased competition and innovation in the surgical robotics industry. As the industry continues to evolve, it will be important to carefully monitor these developments and ensure that patients have access to the most advanced and effective medical technologies available.

Another potential implication of the sale of the AutoLap assets to Great Belief International Limited is the potential for increased adoption of surgical robotics technologies in China and other emerging markets. As healthcare systems in these regions continue to develop, there may be growing demand for innovative medical technologies, including surgical robotics.

However, there are also some potential challenges associated with the adoption of surgical robotics technologies in emerging markets. For example, there may be limited access to advanced medical technologies due to factors such as cost, limited resources, and regulatory challenges. Additionally, there may be a lack of trained medical professionals who are able to effectively use and maintain these technologies, which could limit their effectiveness and impact on patient outcomes.

Another potential implication of the sale of the AutoLap assets to Great Belief International Limited is the potential for increased regulatory scrutiny of surgical robotics technologies. As these technologies become more widespread and accessible, there may be a growing need for regulatory oversight to ensure their safety and effectiveness.

This could include measures such as increased scrutiny of clinical trials and testing of new surgical robotics technologies, as well as increased reporting requirements for adverse events and other safety concerns. Additionally, there may be a need for increased education and training programs for medical professionals to ensure that they are able to effectively use and maintain these technologies in a safe and effective manner.

Overall, the sale of TransEnterix's AutoLap assets to Great Belief International Limited is a significant development in the surgical robotics industry, with potential implications for innovation, competition, and adoption of surgical robotics technologies. While there are potential risks and challenges associated with the acquisition, such as the potential transfer of sensitive intellectual property and the consolidation of the industry, there are also potential benefits, such as increased collaboration and partnerships between Chinese and American medical device companies and increased adoption of surgical robotics technologies in emerging markets.

As the surgical robotics industry continues to evolve, it will be important to carefully monitor these developments and ensure that patients have access to the most advanced and effective medical technologies available. This will require ongoing collaboration between industry stakeholders, regulatory agencies, and healthcare professionals to ensure that surgical robotics technologies are used in a safe and effective manner, and that patients are able to benefit from the potential advantages of these technologies while minimizing the potential risks and challenges associated with their use.